Chart of the Week: Don’t Blame China

Last week’s financial headlines were dominated by Spain and China. In the case of Spain, this was largely due to increased borrowing by Spanish banks from the European Central Bank. For China the culprit was Q1 GDP growth of only 8.1%, which was down from 8.9% in Q4 2011 and well short of the 9.0% whisper number that made the rounds in the day leading up to Friday’s announcement. In fact, once could certainly argue that it was China’s GDP whisper number that was the main catalyst for Thursday’s big rally that was essentially reversed on Friday.

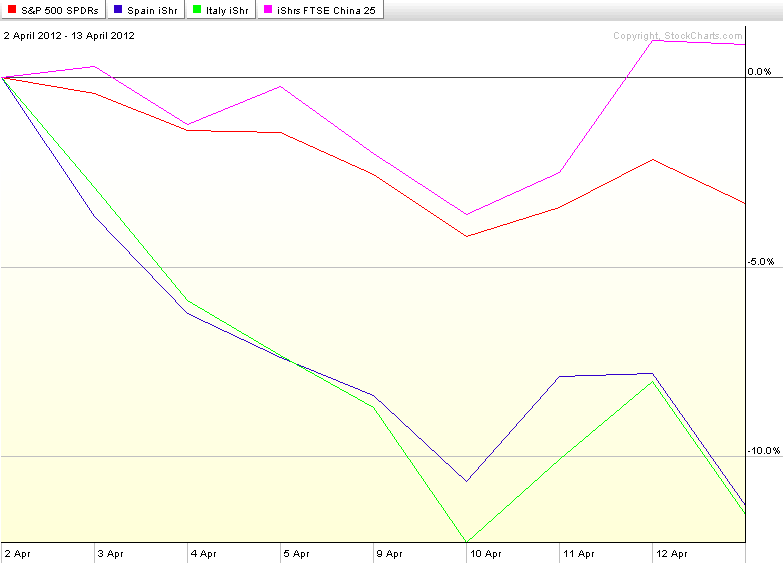

The chart of the week below shows the performance of SPY as well as country ETFs for Spain (EWP), Italy (EWI) and China (FXI) since stocks put in a top two weeks ago tomorrow. The chart shows that while SPY has been declining, country ETFs for Spain and Italy have been falling approximately three times as quickly as their American counterparts. And China? Well, don’t blame China for the woes in the U.S. stock market. While U.S. stocks have been selling off, the performance of the popular iShares FTSE/Xinhua China 25 Index, FXI, has managed to post a 0.9% gain.

[As a side note, about a year ago I discontinued the Chart of the Week, an extremely popular feature in this space since its launch in 2008, as my posting had become sporadic. Going forward I hope to be able to continue my recent regular posting and make this a weekly feature that not only shines a light on key developments of the past week, but also has some archival value as well.]

Related posts:

- Why Not Point Hedges?

- Dynamic VIX ETPs as Long-Term Hedges

- Comparing SPLV and VQT

- Three New Risk Control ETFs from Direxion

- The Case for VQT

- The Year in Safe Havens

- The VIX as a Hedging Tool

- Chart of the Week: Weekly FXI

- Chart of the Week: China Through the Eyes of FXI

- China About to Break Out?

- Time to Be Long China?

- The BRIC Bull

- BRIC Update: China a Leader or an Outlier?

- What’s in the FXI?

- When to Short China?

[source(s): StockCharts.com]

Disclosure(s): none