Natural Gas, Contango and UNG

I have talked at length in this space about the contango and negative roll yield issues that plague VXX. Periodically these discussions trigger a question from a reader about the impact of contango on some of the other ETPs.

Just to be clear, as far as ETPs are concerned, contango and backwardation issues are limited solely to those products which hold futures in their portfolio. The large majority of futures-based ETPs are in the commodity space, but in theory at least, any security for which there are futures could end up with a futures-based ETP. Fortunately, ETFdb keeps a handy list of these products at their Futures-Based ETF page.

The main reason why I talk so much about contango in the context of VIX-based ETPs is that the VIX products have a tendency to produce huge levels of negative roll yield (at a rate of 11% per month at the moment in the front two months of the VIX futures) relative to the other products.

Outside of the VIX product space, contango is probably most notorious in crude oil and natural gas – and the two most popular ETPs for these commodities, USO and UNG. Still, contango in these products is generally much smaller than it is with VXX, but right now contango is unusually high in UNG. While contango (front two months) in USO is only 0.4% right now, it is actually at 7.6% per month in UNG.

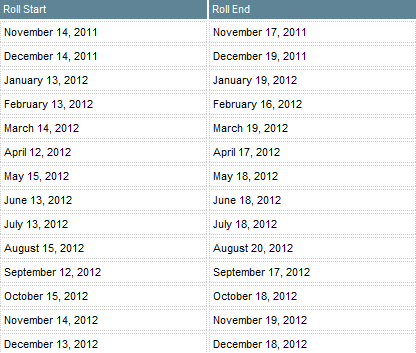

Note that unlike VXX, which has a daily roll, UNG rolls its entire portfolio over the course of four days per month. Better yet, UNG publishes a schedule of their roll dates, reprinted below, though it does come with the disclaimer, “Roll Dates are projected and subject to change without notice.”

So…while it has already been a great year for those who are short natural gas, it is possible that persistent contango will make short UNG positions even more profitable going forward.

Finally and perhaps most important of all, it is critical to keep in mind that steep contango does not happen willy nilly. Instead, contango is essentially a reflection of where the market expects prices to be headed (net of the cost of carry) in the future. Looked at in this context, UNG contango of 7.6% means that the reason shorts are receiving a 7.6% benefit from the negative roll yield is that the market anticipates prices will rebound 7-8% or so over the course of the next month. Contango and roll yield are not a free lunch by a long shot, but over the long term, if risk can be properly managed, positions that benefit from contango should be able to finance at least a few lunches.

Related posts:

- The ETF Energy Troika

- Natural Gas Implied Volatility Spiking

- VXX Calculations, VIX Futures and Time Decay

- Why VXX Is Not a Good Short-Term or Long-Term Play

- VIX Futures Contango Soars

[source(s): United States Natural Gas Fund]

Disclosure(s): short VXX and UNG at time of writing