Opportunities Arising from Unusually Low Implied Volatility in Gold

Gold sure seems like it has been acting more than a little crazy lately, with the commodity recently hitting new highs and threatening the 1300 level and ETFs for physical gold (e.g., GLD) and gold miners (e.g., GDX, GDXJ) attracting a great deal of attention.

If you listen to the media, a number of extreme positions are being bandied about, ranging from gold going to 10,000 to being described yesterday as the “ultimate bubble” by billionaire hedge fund guru George Soros.

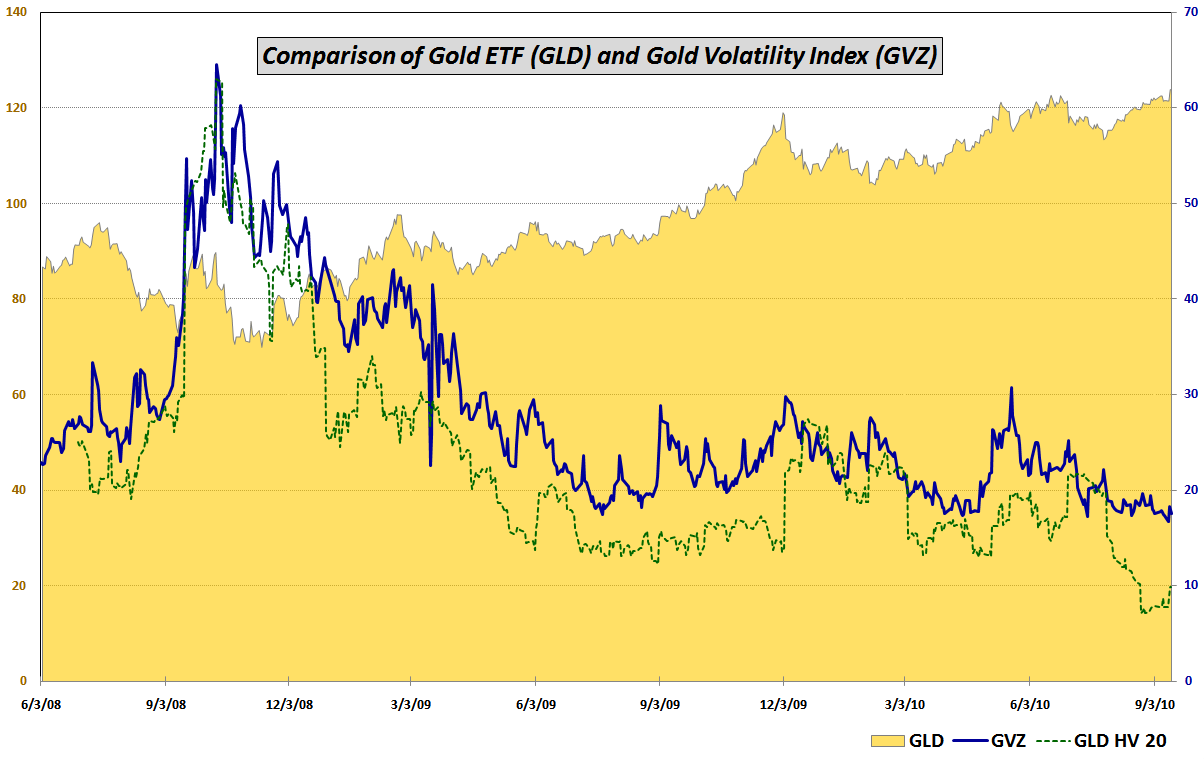

With such strong convictions and emotions riding on the gold trade, this is the type of environment in which one would expect to find extreme volatility. Instead, the exact opposite has been unfolding. As the chart below demonstrates, during the last month the 20-day historical volatility in gold (dotted green line) has dropped to its lowest level in several years. At the same time, the CBOE’s gold volatility index (GVZ), which measures 30-day implied volatility expectations for GLD, has been making all-time lows. GVZ, which has been calculated since June 2008, established a new all-time low on Monday when it closed at 16.69.

With two strong divergent opinions on gold and low implied volatility levels, this could be an excellent time to buy options in order to establish speculative long or short positions in the metal.

In addition to gold’s speculative potential, investors looking for a portfolio hedge or even just a little portfolio diversification might also find gold options to be an attractively priced addition to one’s portfolio at current prices.

Related posts:

- Recent Developments in Gold and Gold Volatility

- Recent Gold Volatility

- Gold and Gold Volatility

- Chart of the Week: Gold

- Three Fear Indicators (or…The Three Baritones)

- The Evolution of the Volatility Family Tree

Disclosure(s): long GDXJ at time of writing